Get instant research and

valuation on any company.

ValuAition

$151.22

8%

$138.85

Share Price

Modify assumptions

Revenue

+93.61%

Last quarter

+152.44%

Last year

Above trend

Above estimates

Above competition

Operations

Growing margins

Improved profitability

Generated cashflow was

allocated to stock buybacks

Balance Sheet

Growing cash balance

No debt, liquidity or

interest rate risk

Products/Services

Graphical Processing Units

Accompanying Services

Revenue Segments

78% Compute & Networks

22% Graphics

Revenue Geography

46% United States

54% Worldwide

Customer Concentration

1 customer = 13% revenue in 2024

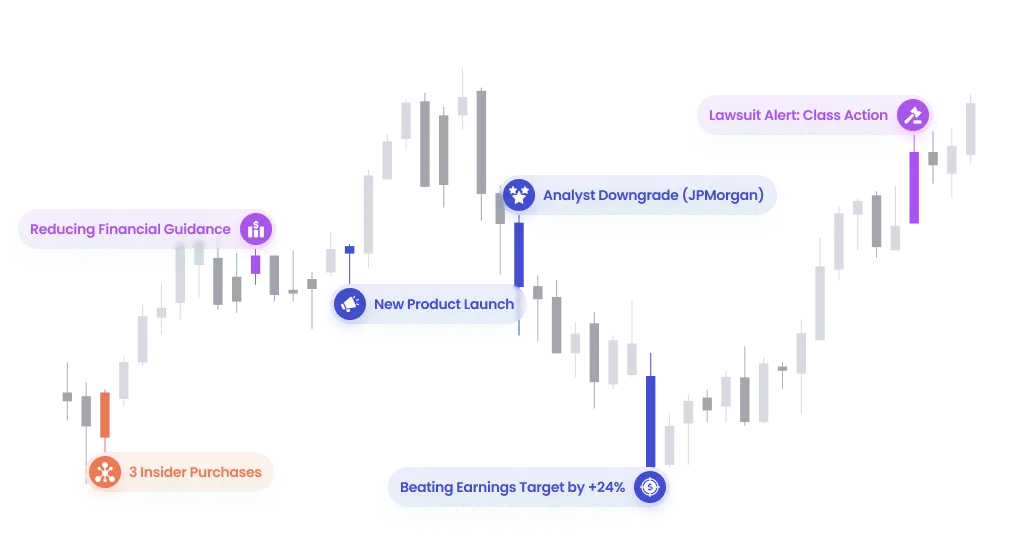

Last Earnings Call (32 days ago)

Read MoreBeating analyst expectations

Revenue - 13.2bln vs 11.4bln • Net income - 2.1bln vs 1.8bln

Raising guidance for fiscal year 2024

Revenue 62bln vs Previous guidance 61bln

Announcing new product launch rolled out in 2026

Share price increased 1142% during 2-years as demand for AI use of GPUs exploded and Nvidia is a market leader.

Record revenue quarterly growth at 260% YoY, significantly above the 3Y average of 120%

Record cash generation, gross (75%) and operating (59%) margins, above 3Y average of (65%) and (42%).

CEO's outlook: continued revenue growth with margins staying in same range.

Current share price is trading above 60x forward cashflow ratio, which is at historical high (see chart).

Conducting record stock buybacks, with 7.74 bln in last quarter and 12.3 bln in 2023.

Management is issuing stocks awards to employees in the amount of 5% of the revenue,which is bellow the average among US stocks. See the chart.

1.25 bln debt has to be repaid in the next 12 months, which represents 17% of current cash holdings.

4 open lawsuit casesagainst Nvidia. None is estimated to materially affect the business.